Discover the very best Hard Money Lenders in Georgia Atlanta for Quick Funding Solutions

Discover the very best Hard Money Lenders in Georgia Atlanta for Quick Funding Solutions

Blog Article

Exploring the Impact of Money Lenders on Neighborhood Economies and Small Companies

The impact of cash loan providers on little companies and local economies warrants careful evaluation, as their role extends past plain monetary deals. By giving easily accessible credit rating to entrepreneurs that may be marginalized by conventional banking systems, these lenders can drive innovation and financial vigor. Nevertheless, the involved risks, consisting of excessively high passion prices and prospective exploitation, raise essential inquiries regarding the sustainability of this support. As we consider both the advantages and challenges posed by money lending methods, one must consider the long-term ramifications for community growth and economic stability.

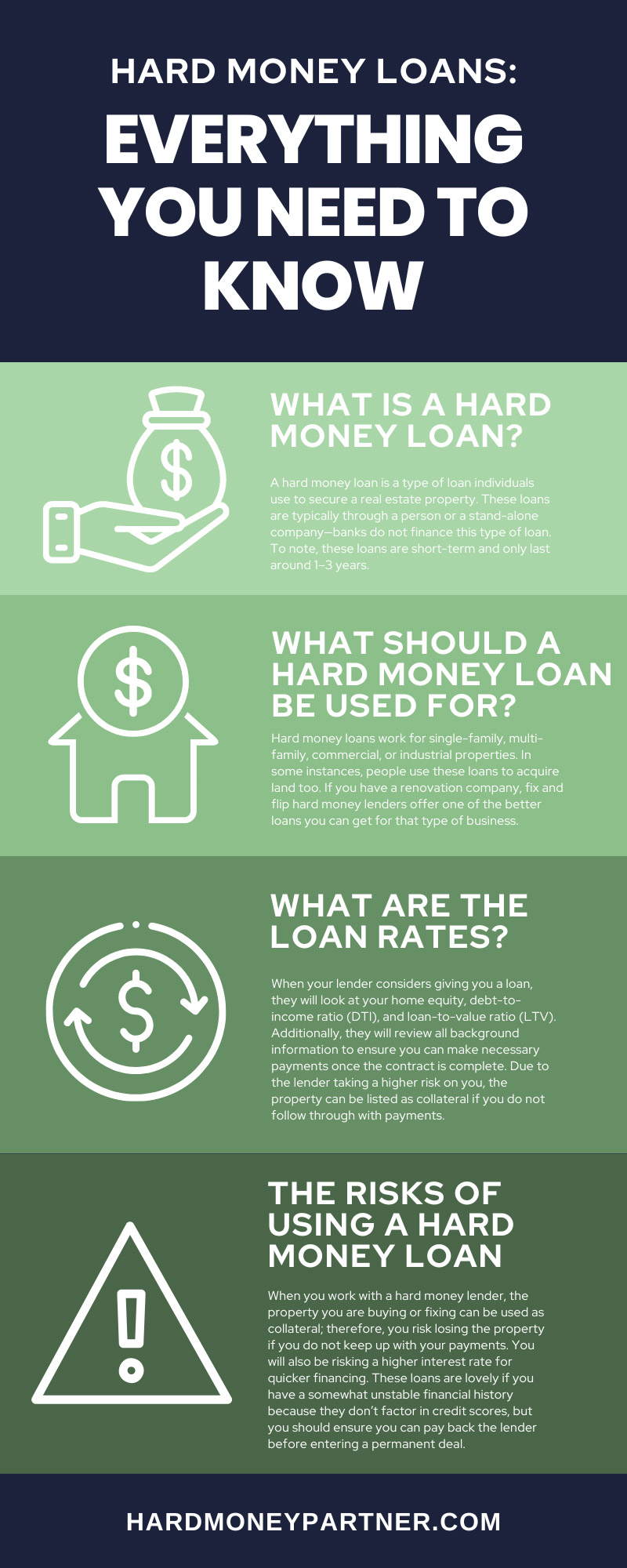

Duty of Money Lenders

In lots of communities, the role of money lenders extends beyond simple monetary deals; they function as essential representatives in the regional economic climate. Money loan providers supply necessary credit to individuals and businesses that might not have accessibility to typical financial solutions. By using finances, they promote usage, allowing homes to purchase goods and services that boost their top quality of life. This prompt accessibility to funds can be important in times of monetary distress or when unforeseen expenses emerge.

Moreover, cash loan providers frequently have a deep understanding of the local market, which permits them to tailor their solutions to meet the certain needs of their clients. This localized knowledge promotes trust and develops partnerships, motivating consumers to take part in effective financial activities. The mixture of capital from money lending institutions can stimulate entrepreneurship, as hopeful company owner take advantage of car loans to begin or expand their ventures.

Furthermore, cash lenders add to monetary incorporation by serving underserved populations, consequently advertising economic variety. Their operations can improve liquidity in the community, bring about increased economic activity and growth. Inevitably, cash lending institutions play a crucial function in maintaining the financial textile of their communities.

Benefits for Small Companies

Many tiny businesses rely upon money lenders for vital monetary assistance that can drive their development and sustainability - hard money lenders in georgia atlanta. Accessibility to funds allows these ventures to buy crucial sources, consisting of stock, devices, and advertising efforts. This financial influx can substantially enhance functional capacities, permitting services to satisfy customer needs better and broaden their market reach

Furthermore, cash loan providers typically offer quicker access to resources compared to traditional banks, which can be vital for small businesses facing immediate monetary demands. This dexterity allows business owners to take opportunities, such as limited-time promotions or seasonal sales, which can bolster profits.

Furthermore, cash loan providers might use flexible settlement options customized to the distinct capital patterns of small companies. hard money lenders in georgia atlanta. This adaptability makes sure that local business owner can manage their financial resources without compromising their functional security

Additionally, the partnership with money loan providers can foster a sense of trust fund and community assistance, as neighborhood lenders usually understand the certain challenges little companies encounter. By offering not just moneying yet also support, cash lenders can play a critical function in reinforcing local economic climates, inevitably adding to job creation and area growth.

Challenges and dangers

While cash lending institutions can offer significant advantages to little services, there are integral threats and challenges connected with relying upon their services. One primary issue is the capacity for outrageous passion prices, which can bring about unrestrainable debt levels. Small companies, currently operating slim margins, might discover themselves caught in a cycle of borrowing to pay off existing car loans, eventually harming wikipedia reference their financial health.

In addition, the absence of law in some loaning methods increases the risk of predatory lending. Underhanded lending institutions might make use of susceptible business owners, supplying finances with concealed charges and unfavorable terms that can threaten the feasibility of business. This circumstance can lead to a loss of trust fund in the monetary system, dissuading responsible loaning.

Another obstacle is the pressure to fulfill settlement routines, which can strain an organization's money flow. If unanticipated costs arise or sales decrease, businesses might struggle to make prompt repayments, possibly resulting in further economic distress or bankruptcy.

In addition, the reliance on temporary fundings can draw away attention from lasting tactical preparation, stifling growth possibilities. In general, while cash lenders can work as a vital resource, their usage must be approached with care to mitigate these intrinsic risks.

Neighborhood Growth Impact

The effect of cash lending institutions on neighborhood growth can be extensive, particularly in underserved locations where accessibility to conventional banking solutions is restricted. By providing vital economic services, these lenders commonly load a crucial space, allowing people and local business to access funding that may or else be unattainable. This increase of funding can boost local economies by assisting in organization development, work creation, and increased consumer spending.

Furthermore, money lenders can add to community development by supporting entrepreneurial endeavors that advertise technology and variety within the neighborhood industry. Tiny services usually offer my company as engines of financial development, and when they get funding, they can enhance their offerings and employ neighborhood homeowners. In addition, the existence of money lenders might urge the facility of local partnerships and networks, promoting a collaborative environment that can bring about additional investment in community projects.

Nonetheless, it is necessary to stabilize the benefits with responsible borrowing techniques. Predative financing can undermine area advancement, resulting in cycles of debt that prevent financial progress. Hence, while money lenders can play a pivotal function in neighborhood development, their methods have to be inspected to ensure they add positively to the neighborhood economic climate.

Future Fads in Financing

Moving and emerging modern technologies consumer assumptions are poised to improve the future of lending substantially. The integration of expert system and artificial intelligence will improve threat assessment designs, making it possible for lenders to make even more enlightened decisions quickly. These modern technologies can analyze large datasets to recognize trends and predict debtor actions, thus decreasing default prices and boosting lending performance.

Moreover, the surge of fintech firms is driving increased competition in the lending landscape. These nimble companies usually offer more flexible terms and quicker approval processes than conventional banks, attracting more youthful customers that value ease. Because of this, traditional lending institutions may need to introduce their solutions or danger shedding market share.

Furthermore, the expanding emphasis on sustainability is influencing lending practices - hard money lenders in georgia atlanta. More lenders are likely to incorporate ecological, social, and administration (ESG) requirements into their financing decisions, promoting liable loaning and financial investment

Verdict

In final thought, cash loan providers serve as important facilitators of debt within neighborhood economic situations, particularly profiting tiny organizations that encounter obstacles to typical funding. Making sure responsible lending techniques is crucial for maximizing favorable area growth results.

The influence of cash lending institutions on tiny organizations and neighborhood economic situations warrants cautious evaluation, as their role expands beyond mere economic deals. Money lending institutions supply vital credit report to people and businesses that might not have accessibility to conventional financial solutions.Numerous tiny companies rely on cash lenders for crucial check these guys out monetary assistance that can drive their growth and sustainability.While cash loan providers can offer substantial advantages to tiny companies, there are integral dangers and obstacles connected with counting on their services.In verdict, money loan providers offer as important facilitators of credit scores within neighborhood economies, specifically benefiting little businesses that deal with obstacles to conventional funding.

Report this page